Intel Moving to Chiplets: ‘Client 2.0’ for 7nm

by Dr. Ian Cutress on August 21, 2020 5:00 PM EST- Posted in

- CPUs

- Intel

- GPUs

- Client

- Intel Arch Day 2020

- Client 2.0

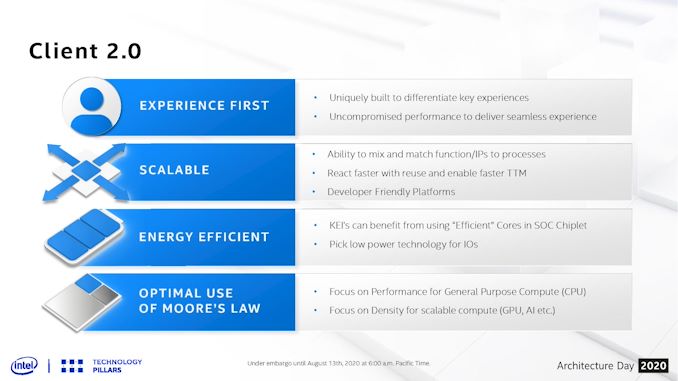

One of the more esoteric elements of Intel’s Architecture Day 2020 came very near the end, where Intel spent a few minutes discussing what it believes is the future of some of its products. Brijesh Tripathi, VP and CTO of Intel’s Client Computing group, laid out a vision about the future of its client products in the 2024+ future timeframe. Centered around Intel’s 7+ manufacturing process, the goal was to enable ‘Client 2.0’ – a new way to deliver and enable immersive experiences through a more optimized silicon development strategy.

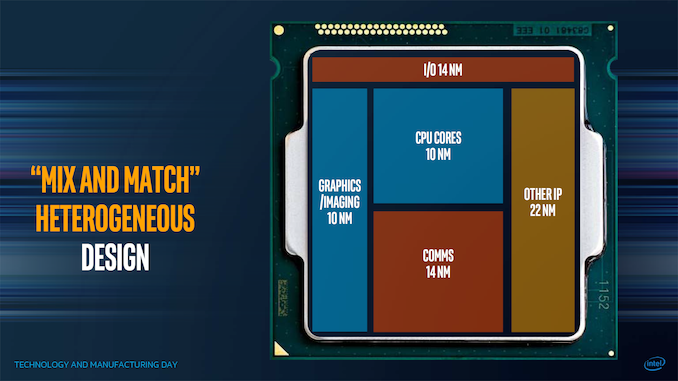

Chiplets aren’t new, especially with recent launches from Intel’s competitors, and as we move into more complex process node development, the era of chiplets enables faster time-to-market as well as better binning and yields for a given product. The key is enabling how those chiplets fit together, and at which points it makes sense to mix and match the relevant ones. Intel has spoken about this before in a more generalized context, at its Technology and Manufacturing Day 2017, as shown in the carousel image at the top.

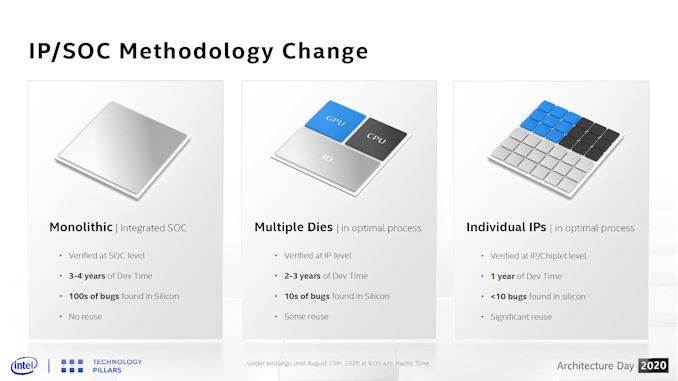

The goal here is to mix and match which process nodes work best for different parts of the chip. Intel seems set to realize this vision starting with its 7nm platform. At Architecture Day 2020, Brijesh Tripathi showed this slide:

On the left is a typical chip design – monolithic with everything it requires. For Intel’s leading edge products, these take 3-4 years to develop, and bugs are found in silicon by both Intel initially and then later by Intel’s partners as they can ramp up the silicon-on time by a a few orders of magnitude.

In the middle is a basic chiplet layout, similar to that slide from 2017, where different functions of the die are split into their own modules. Assuming a consistent interconnect, there are some reuse of the silicon elements, such as AMD using the same core compute dies in client and server. For some semiconductor companies (except Intel), this is where we are.

On the right is where Intel sees its future. Instead of having a single digit number of chiplets in a product, it envisions a world where each IP can be split into multiple chiplets, enabling products to be built with different configurations of what works for the market. In this instance, a chiplet might be a PCIe 4.0 x16 link – if the product needs more, it simply adds in more of these chiplets. Same with memory channels, cores, media accelerators, AI accelerators, Ray Tracing engines, crypto accelerators, graphics, or even as far down as SRAM and caching blocks. The idea is that each IP can be split and then scaled. This means that the chiplets are tiny, can be built relatively quickly, and bugs should be ironed out very quickly.

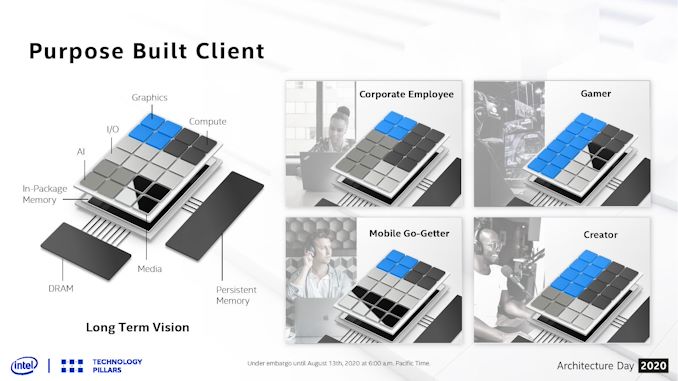

In this diagram, we are treated to Intel’s long term vision for the client – a base interposer with an in-package memory (something like an L3 or L4) that can act as the main SRAM cache for the whole die, and then on top of this we get 24 different chiplets. Chiplets can be graphics, cores, AI, Media, IO, or anything else, but they can be mixed and matched based on what is needed. A content creator might want a balance between some good graphics acceleration and compute, while a gamer might want to focus purely on the graphics. A corporate client or workstation might need less graphics and more for compute and AI, whereas a mobile version of the chip will be heavily invested in IO.

As always, there is some trade-off between chiplet size and complexity of actually putting them together in a multi-die arrangement. Any communications between chiplets costs more power than a monolithic interpretation, and usually offer higher latency. Thermals have to be managed as well, and so sometimes those chiplets are limited by what thermal properties are available. Multi-die arrangements also cause headaches for mobile devices, where z-height is critical. However, the benefits afforded from using the right process at the right time for the right product are big, as it helps provide both performance and power at the best possible cost. It also gives the opportunity to bring in 3rd party IP quickly if something amazing hits the scene.

The only downside here is that Intel hasn’t spoken much about the glue that binds it all together. Chiplet strategies rely on complex high-speed interconnect protocols, custom or otherwise. Current uses of Intel’s die-to-die connectivity are either simply memory protocols or FPGA fabric extensions – the big ones for server CPUs like UPI aren’t necessarily up to the task. CXL could be the future here, however current CXL is built upon PCIe, which means a complex CXL/PCIe controller for every chiplet which will likely get power hungry fast.

Intel has stated that they are inventing new packaging technology and new levels of connectivity to act between the silicon - there is no disclosure on the protocols at this time, however Intel acknowledges that to get to this level of scale it will have to go beyond what the company has today, and that will require creating standards and innovation in this area. The goal is to create and support standards, and the first incarnation will have some standardization built in. Intel states that this is a method of extreme disaggregation, and to note that not everything that is connected has to be high bandwidth (such as USB) or a coherent interconnect - Intel sees the goal involving a handful of protocols throughout the spectrum.

There’s also the developer market, which might be used to a more homogeneous implementation of resources in any given product. Without careful planning, and relevant coding, there is the potential for certain chiplet configurations to fall over if the developer was expecting a certain ratio of compute to graphics, for example. This isn’t something that OneAPI could easily fix.

These are all issues that Intel will have to address, although they have a few years until this comes to fruition. We were told that the internal name is Client 2.0, although it will likely have more marketing dressing added as Intel starts talking about it in more detail.

Related Reading

- Intel's Interconnected Future: Combining Chiplets, EMIB, and Foveros

- Intel 7nm Delayed By 6 Months; Company to Take “Pragmatic” Approach in Using Third-Party Fabs

- The Intel Lakefield Deep Dive: Everything To Know About the First x86 Hybrid CPU

- Intel to use Nanowire/Nanoribbon Transistors in Volume ‘in Five Years’

67 Comments

View All Comments

ads295 - Saturday, August 22, 2020 - link

Damn, a 30% increase in 7 years? Never thought about it that way, but in CAGR terms that's an improvement of less than 4% yearly! That is abysmal by any standard...Quantumz0d - Saturday, August 22, 2020 - link

SMIC and and AMD IP that Hygon and sell it back to west ? Lol not happening. Not even Dems will allow that to happen, current govt blocked ASML tech, even if ASML sells to China they will be robbed just like how Maglev tech was stolen from Germany. U.S pride will be rubbed in sewage if that happens, they are already in TSMC AZ fab deals, ARM DARPA deals, and Intel is not going to sit idle and watch it happen, they are already into that Big little for the ULV and LP CPUs and even S Desktop SKUs, this is probably to get the SMT performance up there with AMD, as Ryzen in SMT is very powerful vs Intel. Plus many nations are against China esp with the current plandemic.And on top RISC V is a unicorn at this point lol, people were saying x86 is dead, its old and all here we are, EPYC7742 is unchallenged for 2 years and ARM Thunder X2 is not going to take any of their market either, as the AMD and Intel will secure years long contracts, only Graviton is core since it reaches masses through AWS EC2 but it's not going to break AMD/Intel at all, the R&D and supply, customer demand is not possible for the ARM, Software is an entirely different story, Apple is in their own bubble, it's not a DC market or HPC at all. Nvidia buying ARM Is the only concern at this point for both Intel and AMD, but as I said they are not going to sit idle and let it happen, Ice Lake is already going for improvements, Intel is going chiplet route for cheaper and faster capturing of market like AMD, copying them essentially since they are out of ideas and they didn't plan for this sitting on the gold mine of cash.

Kangal - Saturday, August 22, 2020 - link

The point was that it was in the works.Now I'm not saying it's probable, but certainly possible that a Nameless Brand from Mainland China surpasses Intel in the coming years. They've been quite hostile in taking trade secrets, bribing experts, and implementing huge projects.

Wether both Republicans and Democrats agree bipartisan is a moot point. And selling back is the last step, obviously not to first-world western nations, but money talks so plenty of second-world, third-world, and Eastern nations will bite the bullet. It's the same story with Huawei's success, they were struggling at 3G tech in Mainland, then out of nowhere they announce cheap international contracts and got all this 4G tech that mimicks what was being developed in Bell Labs, there's a huge funding provided to them from the state, we then find out Nortel (one of world's leading telecoms) was breached several times, they end up losing market share and value, then some of their R&D staff pops up working for Huawei, Nortel declares bankruptcy, Huawei is listed as the world's leading telecom manufacturer.

The world is no longer dependant on x86, and the advancements of Intel/AMD, and are no longer dependant on Microsoft. Not like they used to be back in 2010 or earlier. So it's likely that ARM will continue on improving, to the point, where most of the server marketshare that was trapped under MS running on Intel/AMD may shift radically to running Linux and using ARM chipset. Amazon's offerings have truly been the only proper attempts so far, and they've been mighty successful this early at it, so we will see more of this coming from Amazon and the industry at large. Not sure how you think EPYC is unchallenged, maybe you forgot this is about price, thermals, performance, and support. Server market is big money, and you know who likes money: Apple. They're poised to also make a splash and shake up the market if they choose to do so, they certainly have the hardware and software to do so. That's why it would be disingenuous to not mention them, especially with their announcement to scrap Intel.

RISC-V is a moonshot, but one that's worth mentioning and keeping an eye on. And Intel probably won't recover properly until 2022 when they get their fans running efficiently. So while Intel hasn't caught up to AMD, and won't for some time, how can we substantiate that when the bigger danger seems to ARM where they have No Chance* of catching up, let alone surpassing! This feels like the "iPhone Moment" when it inevitably came to the demise of Nokia, BlackBerry, etc etc.

PS: I don't think Nvidia will be cleared by antitrust to buy ARM, I think that could fall back into the hands of the British. I know the Japanese aren't happy about the last 5-10 years with the loss of their Asian marketshare and resurgence of Chinese corporations and they probably blame the USA for that happenstance.

Zoolook - Monday, August 24, 2020 - link

Nortel never recovered from the IT-crash in late 2000, and finally went under after the 2008 financial crisis. What they did have in LTE-patents wasn't anything the other telcoms went after, it was bought by a consortium including Apple, Microsoft et al, who wanted break into the telcom patent pool.Souped up 3G networks came out around 2010 but real 4G networks weren't up and running until 2013, long after Nortel floundered, if anyone wanted leading edge 4G research they should have hacked Ericsson and Cisco, and maybe they did, we don't know.

Nortel were strong in fiber optics and that is also what has been acknowledged that the chinese hacked.

Spunjji - Monday, August 24, 2020 - link

"Not even Dems will allow that to happen" 🤡"plandemic" 🤡🤡🤡

I'm so glad that z0d's stunning political insights are never far from view.

DareDevil01 - Saturday, August 22, 2020 - link

It's even more abysmal when you compare it to AMDs year on year IPC gains since Zen 1Spunjji - Monday, August 24, 2020 - link

Yeah, I'm amused by how far out into the future they're trying to project and the implications that has for their near-term releases.ksec - Friday, August 21, 2020 - link

Intel is posting a lot of these over the years with no timeline to ship. So I call all of these marketing more than anything else.Unlike TSMC, they post their work and intended shipping time to the client and investors. Knowing exactly when something should be ready.

Not to mention I fail to see how this will save on any cost from its clients. Especially if you consider Intel's margin.

Mike Hagan - Friday, August 21, 2020 - link

Near the end of the 6th paragraph the acronym "IP" is used, but I cannot find it defined anywhere in the article. What does it stand for?IanCutress - Saturday, August 22, 2020 - link

IP is a standard industry/global acronym for Intellectual Property. In this case we're talking about a portion of an SoC - a CPU core, a GPU core, a TB4 controller, a USB controller, etc