The Business of Technology: Intel Q3 2007

by Ryan Smith on October 30, 2007 3:00 AM EST- Posted in

- Bulldozer

Intel's Technology and Closing Thoughts

In comparison to Intel's business situation, their technology situation is fairly straightforward, both in the present and near future thanks in large part to their detailed plans released at the twice-yearly Intel Developers Forum. Rather than repeat what we've said before, we'll provide a quick recap on Intel's technology and product situation. For a more complete description these matters, please take a look at our Fall 2007 IDF Coverage.

On the desktop and mobile markets, Q3 and the rest of 2007 have been very good to Intel. With AMD unable to compete with Intel at the high-end, Intel has the superior technology and has been able to enjoy the higher margins that the high-end provides. At the midrange and below where AMD can compete in performance, their price competition has prevented Intel from being able to clench the same kind of dominating position, but even this is not a bad situation for Intel; it's merely less than ideal. Even with price parity, holding the high-end offers the winner the chance to capture a disproportionate amount of mind share among all prices, which further improves their share of actual sales in the competitive price rangers.

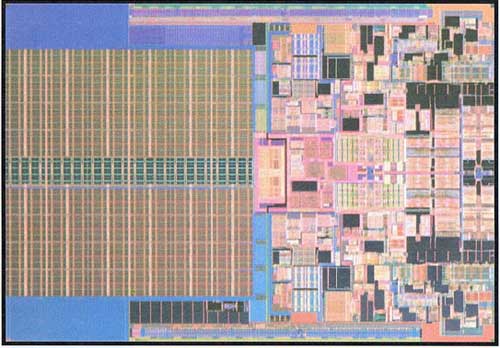

Now in Q4, Intel is about to begin the "tock" phase of their "tick-tock" product release schedule with the release of their 45nm Conroe-derived Penryn parts. With the initial reports of these 45nm parts being very favorable, and AMD not expected to be able to immediately compete with Intel on the high-end with the Phenom launch this quarter, Intel's technology situation in Q4 will largely be the same as that of Q3. Because only a fraction of their CPUs shipped in Q4 will be on the 45nm process, any significant impact from this launch is still a couple of quarters away. The highlight of the situation for Intel will be the usual seasonal pickup in sales, along with the additional bonus of power users upgrading to the new 45nm products.

On the server side, things are and will continue to be less certain for Intel. They're still well in the lead by total volume, but AMD has nonetheless managed to stay competitive with Intel across the entire x86 server segment. Intel's current 45nm schedule for servers is fairly aggressive, giving Intel a leg up against the recently launched Barcelona. However the Xeon line continues to suffer performance and power usage handicaps due to the limitations of their FSB and the use of FB-DIMMs respectively, and Barcelona doesn't need to deal with either of these. With no clear winner across the entire server spectrum, our best assumption is that Q4 will go much like Q3, however with Intel standing to lose some market share. The bigger shifts will be next year.

The press-neglected Itanium line will also be seeing a slight update in Q4. Intel will be releasing a minor refresh of the Montecito, the Montvale, which will bring slightly higher FSB and core speeds along with some new power saving technology. Because Intel does not manufacture the Itanium line so close to the bleeding edge of their process technology, Montvale will still be a 90nm part like Montecito. The Itanium line won't be moving to 65nm until late in 2008.

Finally, the rest of Intel's major product lines will be fairly quiet for Q4. Q3 saw the release of most of the Bearlake series of chipsets for desktop machines, and Q4 is seeing the slow release of the X38 (with X48 now a 2008 part). Also, Intel's software division made a particularly interesting acquisition in Q3 with the purchase of physics and animation middleware provider Havok. Intel hasn't been clear on the reasons for this acquisition, but it's safe to assume that this is driven by Intel's desire to speed along the poky advancement of physics software that effectively uses multiple processor cores, as improvements in per-core processor performance will continue to stagnate compared to the growth in the number of cores per CPU.

Closing Thoughts

Earlier we called Intel a strong company, but we also called them a company that has to fight growth concerns. There is no question in our minds that Intel is currently at the top of its technology game; even in their weakest market (servers) they're still doing very well, while enjoying complete performance dominance of the desktop and mobile markets. On the other hand, Intel's business side is struggling to appease the investment community, in a situation that at first glance is quite odd.

Intel's problem isn't its technology, nor is it an exciting business problem such as bad investments or marketing - the problem is revenue growth. A company holding stagnant is a company one step away from shrinking, which is why there's an expectation on Wall Street that a company should always be growing, and growing as fast as it reasonably can. The issue is that Intel has reached consumer saturation; there just aren't many people left to sell processors to that don't have one.

In the long term Intel will be solving this with new products such as cheaper processors for poorer markets, but Wall Street is looking at the next quarter, not the next year. In lieu of growing the customer base, the short term solution is to grow the profit margins on their products. This is part of the reason why the new 45nm chips will initially be allocated to high-profit, high-cost fields such as servers and the Extreme Edition line of processors, where both markets will pay a significant premium on a processor. It's an unfortunate situation, but isn't something that can be helped. Sometimes the realities of business get in the way of the advancement of technology; this is one such case.

Let's not get too depressed in what is a fairly minor detail that only matters for a handful of people, compared to the rest of the picture. Coming out of Q3 and into Q4, Intel is in the position of a strong company with market dominating technology, and a well developed business practice that keeps the company very profitable. They'll certainly be continuing that trend for the rest of Q4, and into 2008. What about their main competition? Stick around, we'll have our look at AMD's Q3 later this week.

13 Comments

View All Comments

BladeVenom - Tuesday, October 30, 2007 - link

Click on the Yahoo chart, then enter AMD, and compare.BladeVenom - Tuesday, October 30, 2007 - link

Or http://finance.yahoo.com/charts#chart1:symbol=intc...">LinkDfere - Tuesday, October 30, 2007 - link

Good Summary Article.I'm not sure if you have a description correct. I think "expected component" above as used in describing dividends are included in a pricing model as opposed to "required component" is more a appropriate economic term, unless "required component" is an actual economic term I have not been exposed to.

On a devious note, is it merely coincidence that everyone has a computer about time Moores law seems to be breached? I think not. I see someone's hand in this.